Volatility Skew and its Impact on Spreads and Naked Options

In this lesson for advanced Option Traders we use Volatility Skew to determine efficient strategies using Spreads and Naked Options. You will understand the terms "expensive" and "cheap" as used by Option Traders to refer to Implied Volatility levels.

Delta-Gamma Approximation

A quick and efficient way to estimate the impact of market fluctuations on your trades' P/L is to use the Delta-Gamma Approximation formula. You can easily find out how your positions' or even your whole Portfolio's P/L is affected by changes in the market. We'll work out this approximation in an intuitive way and then you will see how it is used with real market data.

Dividend Risk: Options

In this advanced lesson we will look at the effect that Dividends have on Options Trading. We will discuss the risks and potential rewards associated with underlyings paying out Dividends whether on a regular basis or as special dividends with no option contract adjustments. Avoid surprises and be aware of your Dividend risk so you can act on it and take the necessary actions for the benefit of your portfolio.

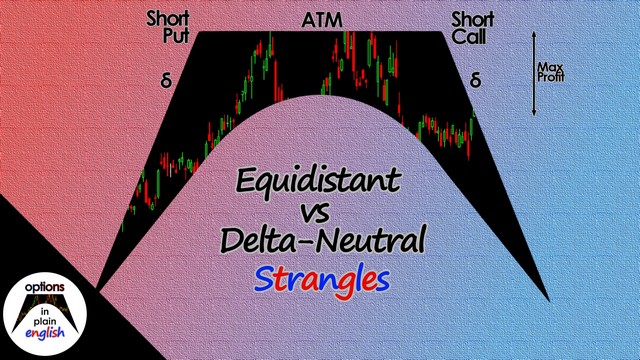

Equidistant vs Delta-Neutral Strangles

Strangles are deceptively simple strategies. However, if you really want to take advantage of them you have to know the differences between an equidistant and a delta-neutral one. In this advanced lesson you will learn about delta-neutrality and how it affects the construction of Strangles and the apparent contradiction that is the fact that a perfectly symmetrical Strangle is seldom delta-neutral.

Winged Creatures: Condors and Butterflies

In this advanced lesson you will learn about Condors and Butterflies and why there are so many versions of them. We will make use of Put-Call Parity concepts to see their similitarities and differences and help you understand basic concepts such as synthetic equivalencies in Option Trading. With this knowledge you will be able to explore and consider different perspectives when looking at complex positions so you always understand where your potential risks and rewards are, even when they are not readily apparent.

Extrinsic Value Dynamics

Understanding the differences between Intrinsic and Extrinsic Values in Option Pricing is key to becoming the best trader you can be. In this advanced lesson you will learn the differences in behavior between Intrinsic and Extrinsic values and how you can apply this knowledge to your own trading whether designing more efficient strategies or adjusting existing ones. You will also see how the lognormal distribution of stock prices also affects the distribution of Extrinsic value in an Option for different price levels of the underlying as well as varying Time to Expiration and Implied Volatility.

Expected Move for Earnings

In this advanced lesson we will determine the Expected Move for the Stock of a company reporting Earnings Results. This type of binary event presents opportunities for traders to try to capitalize on potential earnings-related price moves. We will determine the Expected Move by looking at their options and understanding how their prices determine the market consensus for the potential magnitude of a Stock's move because of Earnings. In particular we will use the information contained in the at-the-Money Straddle for front expirations. This advanced lesson will contain some math and formulas but don't worry, by the end of it you will get a simple approximation and option trading hack which will allow you to easily and quickly determine the expected move of a Stock because of Earnings.

Earnings Volatility-Crush Play: 50/50 Iron Butterfly

In this advanced lesson you will learn a quick and simple way to structure a trade around a company's Earnings Release. We will initiate a 50/50 Iron Butterfly or a 50/50 Iron Condor depending on your preferred capital at risk for this type of trade. This is an ideal trade if your analysis indicates that the current Expected Move for the upcoming Earnings Release is too high and therefore you believe the actual move will be less and fall inside the Expected Move range. These trades also assume that you have no directional outlook so they are delta-neutral and also protect your capital by having a clearly pre-defined maximum loss and not having potentially unlimited risk like a straddle or a strangle would have.

Beta-Weighting your Option Positions

In this advanced lesson you will learn what beta-weighting is and how you can use it to manage your portfolio. It will help you get a better sense of how your portfolio will react to overall market moves and to determine if your directional exposure to the market is what you intend it to be. It will also help you understand what you need to do if you want to hedge or adjust your directional exposure at the Portfolio level. This will be the first step toward looking at your portfolio as a whole and managing it that way as opposed to managing individual positions.

FAQs: Exercise and Assignment

In this advanced lesson we will go over the exercise and assignment process for Options. This is an important, yet often overlooked aspect of Option Trading and a subject you need to be aware of as an Options Trader.

Pin Risk

In this advanced lesson we will be analyzing one of the most important risks for Option Traders: Pin Risk. We will determine the conditions that lead to it and how it affects Options buyers and sellers differently. We will also look at a real example of Pin Risk becoming a potentially unwanted exposure for the Option seller even though those Options expired out of the money. Finally we will explore solutions so you can avoid or mitigate this risk when trading Options.

Inverted Strangles

In this advanced lesson we will take a look at Inverted Strangles, what they are and how traders usually end up with this position. We will then dissect an Inverted Strangle and compare it to a Regular Short Strangle to determine their similarities and differences. Finally we will go over additional risks related to Inverted Strangles when comparing them to Regular Strangles and we will look at an example with real data on our trading Platform for both.

Double-Double Iron Condor

In this advanced lesson we will analyze the Double-Double Iron Condor strategy, what it is and what its advantages and disadvantages are. We will look at the reason why this strategy is an efficient one from a capital utilization's perspective and the compromises that need to be made in terms of directional outlook when compared to the delta-neutral version of the same strategy. You will be given the tools to analyze any type of product and, depending on its IV Skew, determine whether it makes sense to sacrifice directional neutrality in exchange for a higher credit up front and better Return on Capital as long as it requires no additional Buying Power Reduction.

Covered Calls are Short Puts

In this advanced lesson we will analyze one of the most important synthetically equivalent positions in Options Trading: A Covered Call being the same as a Short Put. We will use put-call parity to determine why these positions are equivalent and the ways in which they differ. In particular we will focus on capital requirements, liquidity and dividends as we go through the details of these synthetically equivalent strategies.

Long Call Spreads are Short Put Spreads

In this advanced lesson we will be analyzing Vertical Spreads and determining equivalent positions by applying Put-Call parity to different strategies. By the end of this lesson you will be able to identify Vertical Spreads that have the same P/L characteristics but differ in their components (using puts instead of calls for example). You will also see examples with real data and learn how this information can be useful when you are forced to use one instead of the other to take advantage of better liquidity on an equivalent position.

Adjusting and Rolling Options Positions

In this advanced lesson we will go through the basic concepts related to adjusting and rolling options positions. Adjusting and Rolling positions are some of the most important and often neglected aspects of Options Trading. Very often an options position won't be at a point where it can be closed for a profit and will need to be modified to take advantage of changing market conditions. This is where adjusting and rolling will allow an options trader to modify his or her existing position to better reflect a new outlook on the underlying or simply to address capital usage, price action or any other factor influencing Profits and Losses.

ATM Straddle as a Measure of Volatility

In this advanced lesson we will take a look at the ATM Straddle as a specific options position that can be used to determine many of the properties of an Underlying's Options. First we will use the Black-Scholes Option pricing formula for European-style Options to determine the value of an ATM Straddle, learning also about the Cumulative Standard Normal Distribution while doing so. We will then establish a formula to approximate the value of an ATM Straddle for any underlying with typical ranges of IV and Expirations. We will also look at what the ATM Straddle can tell us about the distribution of Deltas for an Underlying and how we can use it to quickly estimate the Deltas and Prices (Premiums) for a wide range of Options. Finally we will see that we can also use this approximation to quickly estimate an Underlying's IV by using its observed ATM Straddle value.

ATM Delta is not 50 and Probability of Expiring ITM is not Delta

In this advanced lesson we will deconstruct two of the most widely used approximations in the world of Options Trading: ATM Delta being 50 and an Option's Probability of expiring ITM being equal to its Delta. We will determine where these approximations deviate from reality and also how in most cases they are safe to use, while having a general understanding of the direction and magnitude in which they differ from reality for both calls and puts. By the end of this lesson you will have a quick formula for an approximation of ATM Delta and also a practical rule to determine whether Delta overstates or understates Probability of expiring ITM.

Pricing a Strangle from the ATM Straddle

In this advanced lesson we will determine a quick formula to price a 20-delta Strangle from the price of the ATM-Straddle. This will be a good opportunity for Option Traders to understand the pricing mechanisms that underlie the Options Market. We should not rely exclusively on faster and better access to technology and information at our fingertips to understand Option Pricing if we want to become better and more successful Option Traders.

Put-Call Parity

In this advanced lesson we will look at one of the most important concepts in Options Trading: Put-Call Parity. A thorough and deep understanding of Put-Call Parity is necessary if you want to take your trading to a new level and go from being a trader who trades options to a true Options Trader. Put-Call Parity is the fundamental concept behind the synthetic relationships between Stocks, Calls and Puts that allow a great deal of flexibility when designing Option Strategies. These concepts will become second nature as you continue on your Options Trading journey and will enable you to gain new perspectives on existing and new positions, making you a more informed and more efficient Options Trader.

Advanced Option Greeks

In this advanced lesson we will be analyzing how the most important Greeks for Option Traders change as Price, Volatility and Time to Expiration change. We will look at how Delta, Gamma, Vega and Theta react visually to changes in Underlying Price, Implied Volatility and Time to Expiration. This will give us an opportunity to briefly discuss higher order Greeks such as Vanna, Charm, Vomma, Speed, Zomma, Color and Veta. Even if you never have to use higher order Greeks, it is important as an Options Trader to understand how they impact the behavior of the Greeks that we do monitor and pay attention to. Along with this, we will look at quick formulas for the Greeks that we use the most, along with approximations that will allow us to easily calculate the Greeks for your position, using the At-The-Money Straddle and the distribution for those Greeks.

The truth about Calendar Spreads and Raw Vega

In this advanced lesson we will analyze calendar spreads and calendarized options strategies. We will focus on the effect of IV term structure on the Raw Vega of calendarized positions. Calendarized options strategies take advantage of the faster time decay rate in the front expiration when compared to the back expiration. This is why typical calendar spreads are short the front and long the back expiration. In terms of direction, calendars and diagonals benefit from the underlying price expiring at the front expiration's short strike price. An additional advantage that traders see in calendarized strategies is the fact that, since the position is long the back expiration with a higher Vega, these positions appear to be Vega-positive. Nominally when looking at their trading platforms after initiating a calendarized position they would see a positive Vega number and then they would have a position that is both long theta and also long Vega.

Options Portfolio Management

In this advanced lesson we will analyze strategies to design, implement and manage an options portfolio. Managing a portfolio requires a different set of skills compared to managing individual positions. There needs to be a portfolio objective and then a set of guidelines that will help you achieve that objective by using options and options strategies. In this lesson we will go over the most important aspects related to the creation, monitoring and management of a typical options portfolio. We will touch on the most relevant metrics and guidelines that will help with the design of a set of best practice mechanics aimed at maintaining a consistently profitable options portfolio. These will include capital usage, maximum risk per trade, rolls and adjustments, beta-weighted delta, porfolio theta and correlation among others.

Options Trading Cycle

In this advanced lesson we will look at how an options portfolio differs from a stock portfolio and how it needs to be managed cyclically. Unlike a stock portfolio, an options portfolio needs to be changed and adapted constantly because of options' expiration. It is therefore critical that you have a trading plan guiding you through the management of every one of your options positions if you want to achieve consistent profitability and a professional approach to trading options. In this lesson we are going to talk about having a methodology to deal with options trading cycles and how to efficiently close, roll and let options go to expiration. We will look at an example of what an options trading cycle could look like for a primarily premium-selling portfolio. Later we will go further into trade management and look at a flowchart for managing a Strangle, something that is perhaps not explicitly necessary for every trader but also something that most experienced option traders do instinctively.

Introduction to Black-Scholes

In this advanced lesson we will look at the Black-Scholes model and how it can help us understand how options are priced. Options had been around for many years before option exchanges standardized and simplified options trading. One of the most difficult questions to answer was what the fair price of an Option was. Back then, like today, options were priced based on supply and demand. In 1973 Fischer Black, Myron Scholes and Robert Merton published a paper containing a methodology to price European-Style options. Those principles are still in use today, even if the formulas are different, adjusted to address the shortcomings of the initial model. In this lesson we are going to talk about the formula to price European-style options based on Black-Scholes. It uses the Underlying Price, the Strike Price, Time to Expiration, Volatility, Risk-Free Interest Rate and Dividends to determine a fair value for a call and a put. We will even show you how to build your own basic option pricing calculator (assuming European, expiration-only exercise) using a spreadsheet.

Hard to Borrow effect on Options (NKLA)

In this advanced lesson we will look at the effect that a Hard-to-Borrow status has on an underlying's options. We will analyze a real example by looking at Nikola Corporation's options (NKLA).

0 DTE SPX Iron Fly: Stop Loss Analysis

In this lesson we will analyze the 0 DTE SPX Iron Fly and how stop losses affect (or enhance) its performance

Premium Selling strategies by Implied Volatility level

In this advanced lesson we will look at premium-selling strategies and how we can trade them more efficiently. We will also see how selling options can be a profitable strategy as it takes advantage of the passage of time and Volatility contraction as long as the underlying price does not make a large move against us. By the end of this lesson you will be able to determine which premium-selling strategy is ideal for the current Implied Volatility environment along with your directional outlook and available capital.

Box Spreads and the legend of 1RONYMAN

In this advanced lesson we are going to talk about a couple option strategies that are indifferent to the price of the underlying: Box Spreads. Box Spreads are made up of a synthetic long position with options at one strike and a synthetic short position with options at another strike, with the difference between strikes being the value of the Box. Box spreads' values depend primarily on factors that are not related to the price of the underlying; such as Dividends and Interest Rates. They are often used as a mechanism to lend funds to the marketplace in exchange for interest income in the case of a long box spread; or as a way to borrow funds from the marketplace at market rates in the case of a short box spread. Together with Conversion and Reversals as well as Jelly Rolls they belong to a series of strategies known collectively as locks, since their value at expiration is locked from inception and only depends on the dividends and interest rates of their components. We will also analyze potential risks particular to box spreads and we'll see what we will need to look out for when a strategy's profile seems "too good to be true" and the dangers that may be lurking beneath the surface.

Top 10 Books on Options Trading

Option traders have many choices when it comes to books on options trading, fundamentals and strategies. With so many to choose from, the question becomes, what are the books that will ultimately help you become a better options trader. Along with this, which ones should you approach first as you start learning and which ones are the best to help you later on once you have a solid understanding of options basics. With this in mind, I have created a list with the top 10 books that will help you get started with option trading and later on become the best option trader you can be.

Call spreads can be Put spreads? Vertical spreads revisited

If you’re an options trader there’s a good chance that one your go-to strategies is a vertical spread. A vertical spread is made up of 2 legs, one that is bought and one that is sold; with the same number of contracts, in the same underlying, for the same expiration and of the same type call or put. The only difference between the 2 legs being their strike price. Today we’re going to look at some misconceptions about vertical spreads and how in reality you could say that call spreads can be put spreads and also that debit spreads can be credit spreads. I know that seems like a contradiction but stay here and you will see what I mean and hopefully get a better understanding of how vertical spreads really work and how you can use them effectively in your own trading.

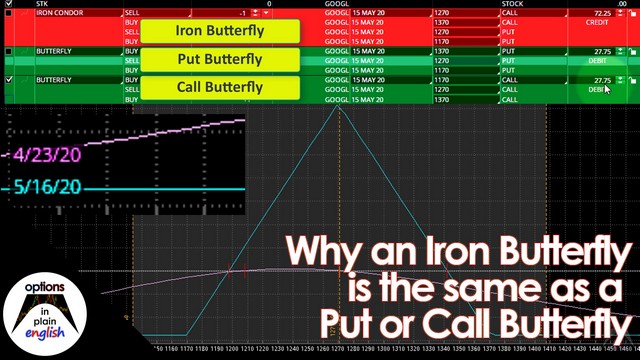

Why an Iron Butterfly is the same as a Put or Call Butterfly

In this lesson we'll analyze an Iron Butterfly, a Put Butterfly and a Call Butterfly on the thinkorswim platform and we'll see how all of them are synthetically equivalent positions.

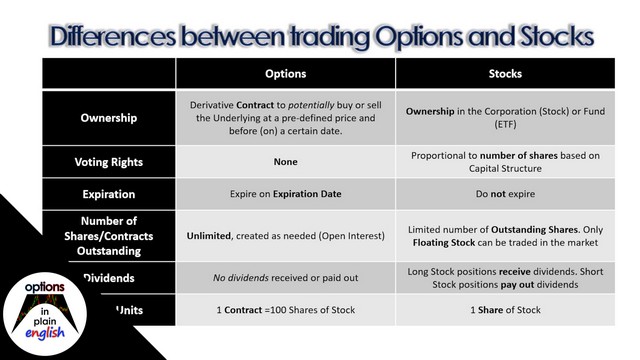

What are the differences between trading Options and trading Stocks?

Differences between trading Options and trading Stocks.

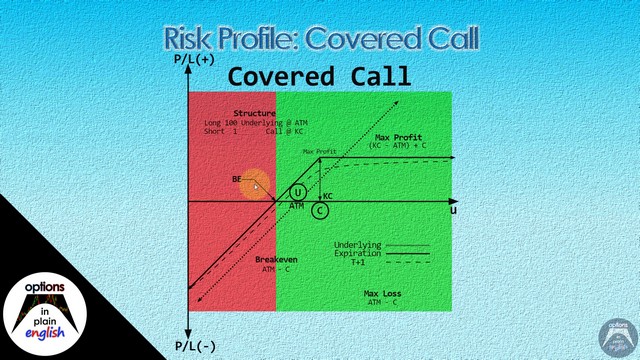

What is a Covered Call?

In this lesson we will analyze the risk profile of a Covered Call strategy; its advantages and disadvantages, margin considerations and how to structure it. We will also discuss synthetically equivalent positions by comparing and contrasting a Covered Call with a Short Put strategy.

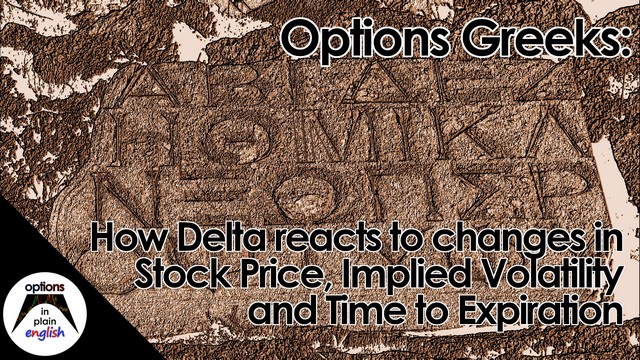

Options Greeks: How Delta reacts to changes in Stock Price, IV and Time (Gamma, Vanna and Charm)

How Delta reacts to changes in Stock Price, IV and Time (Gamma, Vanna and Charm).

Differences between current P/L and P/L at expiration: Why you're not getting the profits you expect

Option traders often complain that they are not getting the profits they expected out of their options positions even when the underlying did what they were expecting it to do. This is often a result of not understanding the differences between their position's current p/l line and the p/l line at expiration when looking at a payoff diagram. In this lesson you will better understand the interaction between underlying price, time to expiration and implied volatility when analyzing your options positions. You will also see how the current p/l line for many of the most widely used options strategies evolves over time and how this might explain potential discrepancies you might be seeing between expected and actual profits in your portfolio.